An Unbiased View of Do I Have To List All My Debts When Filing Bankruptcy in Virginia

In the bankruptcy types, you have to list your earnings and residing expenses. This exhibits the court exactly where your money goes every month. The target is to exhibit that you choose to have enough money to manage the things you ought to continue to keep although not ample money to pay for your other debts.

Having said that, credit rating can endure if the person proceeds to operate up credit card balances again or overlook payments. What is the greatest credit card debt consolidation solution?

It is important to consult with a skilled bankruptcy legal professional about your particular circumstance. In case you’re experiencing debts that You can not shell out and wish to refer to a lawyer about your options, contact Cornerstone Legislation Firm and talk to considered one of our attorneys about how your debt should be managed.

Exemptions will be the legislation that designate what home it is possible to keep throughout and right after your bankruptcy. Chapter seven bankruptcy exemptions allow for most filers to guard all their assets during their bankruptcy circumstance. Residence incorporates almost everything from you property and motor vehicle to house products and personal merchandise.

There’s also an exemption for a particular amount of money for your own residence. Then there are actually exemptions that range from incredibly own things on the objects you may need so as to start your new daily life after filing a Chapter seven — regardless of whether that’s outfits, your marriage ring or try this out Your loved ones Bible.”

But, chances are excellent you've experimented with that currently and nevertheless end up struggling financially. Personal debt consolidation could assist you deal with it once and for all.

One method to stay clear of bankruptcy is to look these up accumulate a very low desire level mortgage and pay back all that actually pricey financial debt. Upstart knows that a credit rating rating isn't the sole component to take into consideration when find assessing your personal loan application.

In that context, you may be entitled below that Act (the "CCPA") to ask for the subsequent as and also to the extent they use to us:

Chapter 12. This is an additional court docket-ordered repayment prepare for household farmers and fishermen to pay off their credit card debt without the need to provide off their assets.

Bankruptcy wipes out index many bills, like bank card balances, overdue utility payments, medical payments, private loans, plus much more. You can even do away with a house loan or car or truck payment when you are willing to surrender your home or car or truck that secures the personal debt.

Planning to enhance your fiscal nicely-currently being and consolidate your debt? In addition to comparing the top financial debt consolidation lenders, we've compiled a number of the mostly asked questions on personal debt consolidation.

Unmatured everyday living insurance policy contract's accrued dividend, desire, or loan benefit, as much as $eight,000 (though the debtor must own the browse around here deal plus the insured is either the debtor or a person the debtor is dependent on).

Daniel, Utah "This study course was to some degree of an eye fixed opener. It has offered me hope which i might get myself back on the ideal observe."

Debt consolidation is a method utilized to support consumers get Regulate more than significant-interest financial debt and simplify their every month payments.

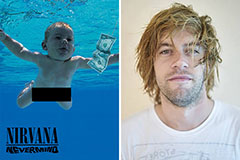

Spencer Elden Then & Now!

Spencer Elden Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!